The demand for chemicals and petrochemicals has been restored with the gradual easing of the economic effects of the pandemic and global supply chain squeezes and is projected to grow over the coming years. The Kingdom of Saudi Arabia (KSA) has an abundance of natural resources and qualified workforce that enables the nation to be a strong player in the global petrochemical supply chain. Businesses in the region can foster higher productivity of their products while also navigating rises in feedstock price.

Even as KSA plans to diversify its economy, the increasing demand for petrochemicals creates several opportunities that can be capitalized by businesses in the region. Let’s explore the potential of the sector and ongoing trends that are driving a need for petrochemical businesses in KSA to transform their supply chain and tap into a wider spectrum of trade possibilities.

What is the current role of KSA in the global chemical supply chain?

Housing a wide number of the largest global petrochemical companies, the Kingdom of Saudi Arabia (KSA) contributes approximately 10% of the total volume of chemical trade globally. In fact, the sector is the most lucrative industry in the country contributing to about 50% of its GDP. Some of the key products traded by the country includes ethylene, glycol, polyethylene, and tert-butyl ether (MYBE).

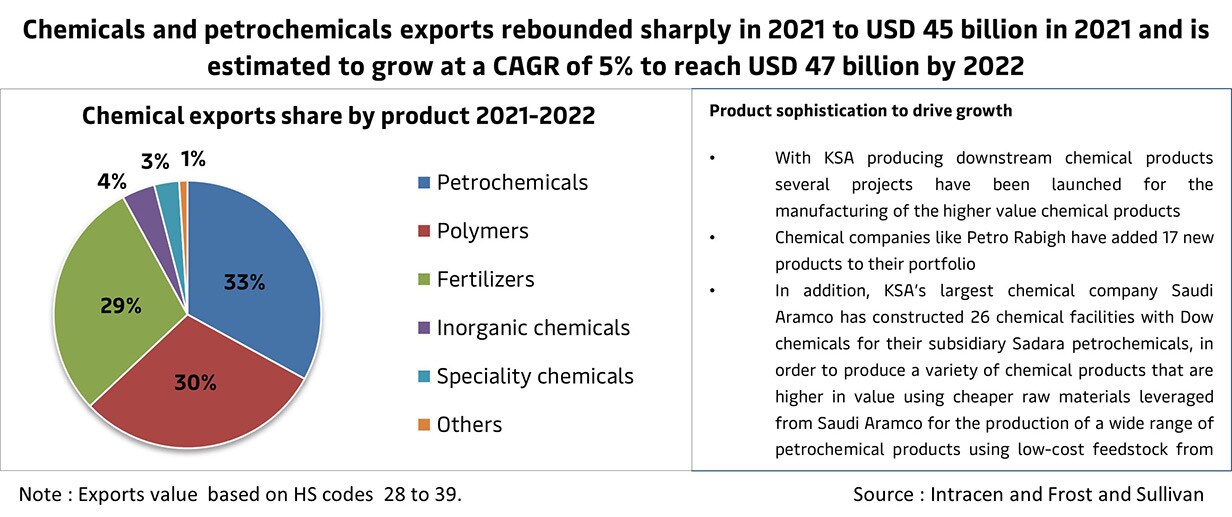

In fact, despite the impact of the pandemic on almost all industries, KSA’s chemical and petrochemical exports rebounded sharply in 2021 to USD 45 billion and is estimated to grow at a rate of 5% to reach USD 47 billion by 2022.

The main reason for this is because the demand for chemicals, be it basic, intermediate or specialty, is projected to increase due to urbanization. Increasing global demand was also witnessed for food and beverage, textile, transportation, cosmetics and pharmaceuticals as a result of more consumer spending around the world on travel, home improvements, apparel and lifestyle products, protective gear like PPE kits amongst a host of other items which require petrochemical materials for their production. The demand for petrochemical exports from KSA is especially stronger from the biggest Asian economies like China and India which are emerging as key manufacturing hubs for consumer products across a variety of industries and thus are a large consumer base for petrochemical products.

KSA has undertaken several initiatives to strengthen the competitiveness of local chemical and petrochemical manufacturers to compete with players in the global market and drive growth. Like the subsidization of the cost of ethane for petrochemical companies. Additionally, raw materials like butane and propane have been made available at a discounted rate in the market.

Additionally, the country has also been steadily working to increase foreign investments as well as investing in applications of advanced technology. The anticipated result of this is a more sophisticated product range, expansion of local consumption and rise in export numbers. The up scaling of non-oil chemical sector is expected to generate higher value products which currently contribute to about 60% of the country’s non-oil exports.

Why Should Petrochemical Companies in KSA Transform Their Supply Chain?

Focus on End-to-End Growth of the Sector: With Vision 2030, the Saudi Government plans on raising production and export numbers two-fold with several financial incentives and policies. Its focus is to push the growth of the petrochemicals and chemical sector across every node in its supply chain, right from manufacturing to logistics to capture a higher share of the market.

Focus on Specialty Chemicals: KSA’s Industrial Clusters program aims at enhancing plastic processing industries, technology and conversion focusing on investment and growth of key industries relying on chemicals which are plastics and packaging, minerals and metals, home appliances, automotive, and solar energy. By supporting plastic conversions, the government plans on increasing the productivity and supply chain of specialty chemicals.

Development of New Value Chains: New value chains are expected to be developed in sectors like rubber products, oil and gas chemicals, modern plastics applications, mining chemicals, construction chemicals, pharmaceutical, nutritional additives and other personal care related chemicals.The Chemicals Cluster strategy, formulated by Saudi Arabia’s National Industrial Development Center (NIDC), aims at nurturing the new value chains for the success of its Vision 2030. In other words, by fostering the growth of these value chains, the country can capitalize on its available natural resources and the advantages of a qualified workforce.

Push For Decarbonisation: Decarbonisation is at the heart of the Saudi Vision 2030 across policy development and investment to planning and infrastructure. The country announced a $190 billion spending plan to reach net zero greenhouse gas (GHG) emissions by 2060. The government is also pursuing a progressive and measured approach to implement a more comprehensive solution towards reducing GHG emissions. The framework of KSA’s Chemicals Cluster strategy aims at reducing its dependency on crude oil and expanding the natural gas segment for an alternative source of electricity. The Saudi Arabian government is also increasingly investing in the chemical sector to promote its growth by expanding and developing its hydrocarbon and gas production. The high nation-wide focus on decarbonisation is driving the need for businesses in the sector to incorporate it into their core business strategy and consider it across their entire value chain including their suppliers and logistics providers.

How Can Businesses Secure a Resilient and Agile Supply Chain For the Future?

The supply chain for the chemical and petrochemical industry can be quite complex. Chemical raw materials and products needs to be stored, moved across borders swiftly and safely while also being able to respond quickly to supply chain disruptions or changes in demand. With KSA’s increasing initiatives to enhance its chemical and petrochemical industry, businesses need to transform their supply chain with a focus on increasing visibility, resilience, agility and safety. Securing this supply chain can help support their business reach and growth. Some of the factors they need to consider are:

Proper handling and safety in chemical logistics: High quality equipment for handling and temperature control can ensure that chemical products are transported in accordance with statutory regulations and safely instruction. Logistics activities for hazardous and dangerous specialty chemicals are already complicated and the inclusion of multiple logistics stakeholders adds to this complexity. There is a significant reduction in risk for chemical companies when they associate with a reliable and trustworthy partner who have the right infrastructure, capabilities, and best practices, incorporate quality and safety checks, and who ensure proper employee training and management.

Custom processes and procedures: International shipment of some chemicals and petrochemicals requires stringent monitoring. Therefore, the enabling of quick custom processes which are thoroughly checked through logistics service providers can help maintain the integrity of the chemical products to be transported. It is vital that chemical companies partner with logistics providers who have a wider global reach and are knowledgeable about various markets and their requisite compliances, quotas and regulations.

Need for proper storage: Central to the chemical sector is its need for proper warehousing and storage with special equipment that ensures safety of the chemical products, environment as well as the employees. This requires a very high degree of safety measure to be upheld by LSPs so the chemical products reach their destination in proper condition. Solutions offering tailor-made logistics solutions for chemical and petrochemical sector are essential with proper management systems and storage solutions.

Digitalization: Optimization of digital technology has become a crucial and integral part of a company’s overall value chain. Investment in digital tools and analytics helps businesses identify new products and services, target markets and suppliers and thereby add efficiency, resilience and agility to their operations. While the pandemic accelerated the shift towards technology, leveraging digital tools that can analyse and estimate demand, trace raw materials to sources, automate different aspects of their operations and optimise supply networks helps businesses reduce costs, time and manual efforts while making processes like exchanging data on documentation more seamless and hassle-free.

Visibility and monitoring: As supply chain management reaches new heights of efficiency with technologies, visibility has become a crucial expectation from LSPs. The need for visibility in the chemical industry is high, as tracking, tracing and monitoring temperature conditions of shipments are essential given the nature of the chemical products. With proper logistics implementation, safety measures, necessary equipment with visibility and monitoring, KSA’s chemicals and petrochemicals will prove to be one of its most lucrative markets supporting and boosting the country’s global economic position.

All data included in this article was provided by Frost & Sullivan and Intracen.

未来,您想随时了解必读行业趋势吗?

您已经完成了,欢迎“登船”!

很抱歉,发送您的联系请求时出现问题。

请查看表单字段,确保所有已正确填写所有必填信息。如果问题仍然存在,请联系我们的支持团队以获得进一步的帮助。

未来,您想随时了解必读行业趋势吗?

使用此表格注册,即可直接在您的邮箱中接收我们的洞察见解,进入一个真正的综合物流世界。简单操作,即从我们为您量身定做的精选文章中获得启发,了解相关行业洞察信息。您可以随时取消订阅。