Key Notes on North American Supply Chains

- Port Houston import dwell fee goes into effect February 1st: The Port of Houston announced a Sustained Import Dwell Fee to help maintain fluidity at the Bayport and Barbours Cut Container Terminals and address long-term dwell. The $45 fee will be charged per unit per day starting on the eighth day after the expiration of free time. This fee is in addition to the demurrage charges for loaded import containers provided for in those subrules and does not replace those charges. Containers will be on hold until all terminal fees are reconciled. Payment of such fees will be the responsibility of the cargo owner. Maersk recommends customers pick up their cargo within freetime.

- California's “Senate Bill 1” ban on pre-2010 diesel vehicles over 14,000 lbs effective Jan 1: California Air Resources Board (CARB) clean air regulations implemented in 2008 state that diesel vehicles weighing over 14,000 pounds and built before 2010 are banned from operating on California roads as of January 1st. CARB estimates this will affect around 70,000 vehicles. Terminal operators in Los Angeles-Long Beach and Oakland have programs in place to enforce the regulations. The ban will have negligible effects on Maersk landside transportation services given its use of newer vehicles.

- US Customs and Border Protection (CPB) Modernizes the Broker Regulations The CPB instituted new broker regulations effective December 19, 2022. Major changes include:

- Transitioning local permits into a national permit

- Creating new standards for “Responsible Supervision” and “Control Requirements”

- Require direct powers of attorney and communication with importers when Freight Forwarders control the relationship

- Setting standards for security breaches

- Codifying “customs business”

Codifying of “customs business” is particularly impactful because it restricts classifying imported products beyond six digits and requires the work to be done by a customs broker inside the United States, unless done by the importer of record.

For additional insights on how the new regulations may impact your business, contact your Maersk Customs Services representative.

Ocean Update

Ocean network optimization has been a main focus for Maersk in the run up to the Chinese New Year holiday period, which begins on Sunday, January 22nd, and culminates with the Lantern Festival on February 5th. Cargo volumes have continued to fall as US ports handled just under two million inbound 20-foot equivalent containers in December, down 1.3% from November, according to Descartes Datamyne. Year-over-year industry volumes for December were down 19.3%, settling close to the December 2019 volume levels, just prior to when the early 2020 wave of covid lockdowns began.

Peak periods during the pandemic had limited our planners’ abilities at the time to adjust ocean network schedules out of concern of affecting greater disruption in the face of strained capacity.

However, recent volume reductions have enabled our planners to proactively adjust and optimize the network, having completed a significant analysis of booking trends. Of note this January, there have been service changes on our North Europe / North America corridors as well as to and from the Mediterranean via our 2M Transatlantic Network with MSC. We have been just as engaged on optimizing schedules on the Transpacific, where efficient operations call for blanking some sailings and inducing others as needed to re-establish schedule stability.

The intent of these latest adjustments to sailing schedules is to improve the reliability of our services. Achieving a state of reliable, stable, and consistent scheduling will better enable our customers to forecast, plan, and deliver on behalf of their end customers on a timetable they can count on.

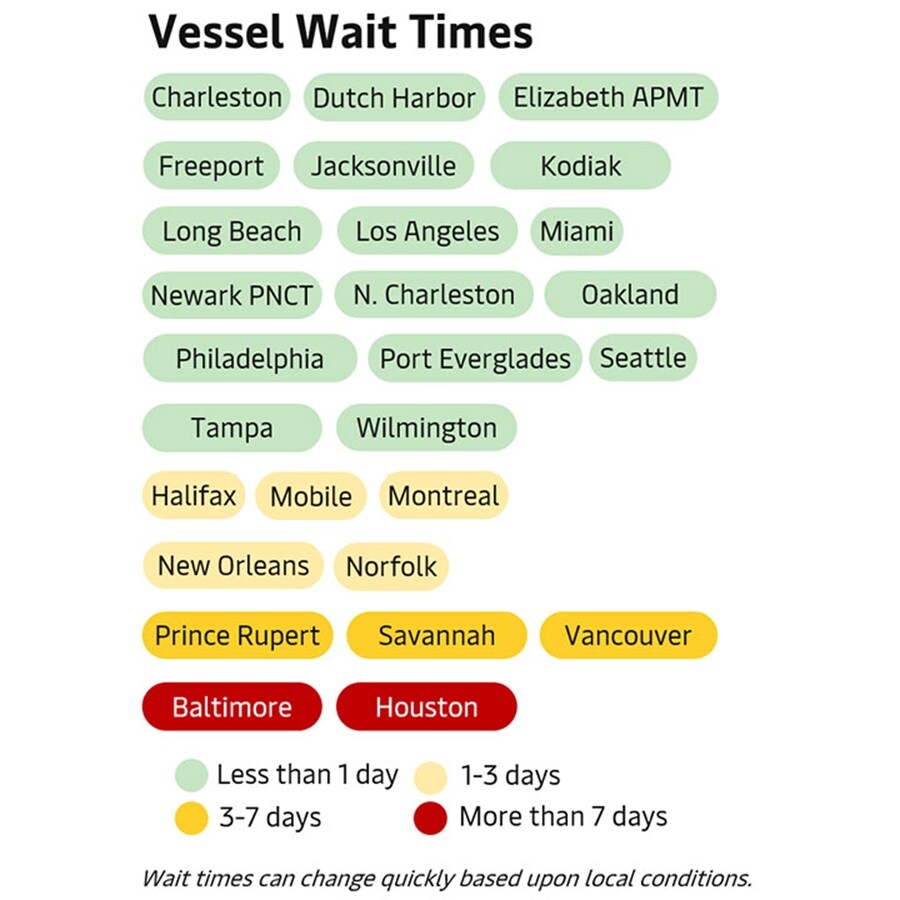

Empty container volumes remain healthy within the US and Canada. We do have some deficit locations in the Ohio Valley and Houston, but we are actively pursuing repositioning opportunities to cover demand. There is less congestion within the rail and truck networks, which is helping with positioning empties as needed. We are also seeing less congestion within our depots and terminals. There is reduced waiting time across North America with many terminals at zero days waiting time.

Longstanding dwell volumes remain stable across terminals. Our highest import dwelling volumes are at Elizabeth APMT, Savannah, and Los Angeles. Highest export dwelling volumes are at Norfolk, Houston, and Long Beach.

Looking beyond the Chinese New Year period, Maersk customer sentiment reflects that the vast majority of Chinese factories will likely be re-opened by the week of Feb 6-12 along with the return of landside trucking capacity to support the movement of goods as needed.

West Coast Highlights:

Vancouver: Winter weather has significantly impacted operations. Vessel delays have risen to an average of 6-days. Rail dwell has risen to an average of 8-days with yard utilization at 90%.

Seattle: Due to general lack of demand, the terminal will be closing gates on a regular basis on Fridays. Capacity is currently at 50%. Due to available yard space the terminal is planning on bringing back on-dock rail, including NWCS express train to/from Portland by late January.

California: Oakland, Los Angeles, and Long Beach have been subject to a series of extreme storms producing heavy winds and rain that have reduced productivity, though vessel wait times remain negligible. Due to low volumes in LA, gates are now closed on 1st and 2nd shifts on Fridays, and 1st shift on Saturdays.

East Coast Highlights:

Baltimore: Delays continue due to reefer plug availability. The terminal is using 2-4 power packs to support lack of reefer plugs. The terminal installing 70 new reefer plugs that should be operational by mid-February. Vessel wait time is sitting at 8-days for ships coming in on the TP12 from eastern China through Busan, Korea to Northeastern US ports. Waiting times have decreased due to improved labor attendance, improved yard space availability, and decreased reefer volumes. Significant improvements are anticipated in February.

Savannah: As of mid-January, there were nine container vessels at anchor, though no Maersk vessels. Class 2 vessel wait times are at four days on TP16 in from China and Busan, Korea.

Houston: Vessel waiting times are 3-days at Barbours Cut and 8-days at Bay Port. Dwell fee to be implemented February 1st.

Landside Updates – Transportation

Roll towards sustainability starting today

According to the 2022 Global Sustainability Study by Simon Kucher & Partners, 71% of consumers around the world are making changes to live more sustainably and buy more sustainable products. Many of our transportation customers are pursuing the same goals as they seek to differentiate their businesses from the competition. However, while there is excitement about what the future holds, our teams are hearing first-hand that some supply chain managers are being given 2023 KPIs, and even bonus incentives, tied to achieving sustainability gains this year. As such, our teams are being asked what technologies and equipment can be used to improve sustainability right now.

For starters, we have begun making EV trucking available in limited markets. As a result of orders placed last year for more than 400 EV trucks manufactured by Volvo and Einride, Maersk has begun to deploy and operate Class-8 battery-electric trucks. Our first electric trucks are currently operating in Performance Team’s Santa Fe Springs and Commerce, CA, distribution centers. The zero-tailpipe emission trucks are currently being used for drayage in and out of Los Angeles and Long Beach with wider applications planned for the future. Charging stations for the trucks have been established in both the Santa Fe and Commerce locations and are powered by non-fossil fuels as well.

EV Upsides

- Emissions reductions

- Significant fuel savings

- Elimination of Port of LA/LB “clean truck fee” by utilizing EV/Zero to low emissions tractors

- 8–10-year battery life

By February, the landside transportation team plans to begin operating Gen 2 Volvo EV trucks in metro Chicago in service of the CenterPoint Intermodal Center, which is considered one of the largest inland ports in North America. By May, the team will continue its EV expansion plans by introducing EV trucking power in service of the Port of New York and New Jersey.

In addition to EV trucks, Maersk is working on a pilot program with other sustainably focused companies by testing the effectiveness of hydrogen powered trucks. We are currently building up a program out of the Port of Oakland using hydrogen vehicles that have ranges in the 500–600-mile range.

As always, our landside transportation operations employ modern fleets that apply US EPA SmartWay principles to improve freight transportation efficiency. EPA-verified technologies save fuel and reduce emissions with technologies such as aerodynamic devices, idling reduction equipment, and new and retread low-rolling resistance tires. For more information on improving the sustainability of your transportation solutions, contact info@performanceteam.net or visit our Truckload Transportation pages on Maersk.com.

Landside Updates – Warehousing & Distribution

Yes, it’s already time to prepare for 2023

peak warehousing season

At 3.3%, the Q4 vacancy rate for U.S. industrial real estate ticked upwards by just 0.2% in 2022, according to commercial real-estate services firm Cushman & Wakefield, reversing a near two-year trend, while goods inventories have also moved (somewhat) past peak as well. Yet, despite the respite, warehouse managers got only a short reprieve before they had to jump headlong into preparations for the 2023 peak season. In fact, the warehousing professionals we work with day-in and day-out are already two-thirds of the way through an annual planning cycle that hinges upon post-peak reflections, a budget review, and implementation initiation.

As with achieving most annual goals, making progress early is critical. Hitting the reset button in January is particularly important in order to build in the 3-5 months needed to implement a new warehousing plan for a May/June “go-live” date. By Q3, seasonal pressures will begin to build, thus making “go-live-by-June-or-push-to-24” a real planning consideration for supply chain managers.

Reflecting on the “stress test”

Annual peak performance reflections often begin just days after Thanksgiving weekend. By then, the dust has begun to settle from the supply chain “stress test” of Black Friday followed by Cyber Monday. What stood out? Were all the e-commerce orders filled? Were the warehouses all caught up, or still two weeks behind? Was the customer promise met? What is the condition of the warehouse and how did the staff hold up? Did they have to work 24/7 to keep up?

These questions and more will inform decisions around whether a company wants to make warehousing and distribution a core competency, or to outsource the task to focus organizational resources on production, sales, and marketing instead.

Budget Review

Layering atop the stress test reflection is a budget review that looks back at the total cost of last year’s supply chain exercise and what budget is available for this year’s operation. Three costs under great scrutiny are the inbound freight to position the goods, the real estate to warehouse the goods, and finally, and often most costly, outbound parcel or fulfillment costs to distribute the goods to the end user.

Some of these calculations are easier than others. The Cost Per Unit (CPU) falls to the easy side of the equation, whereas the “Customer Happiness Quotient” may prove to be somewhat elusive. As customer satisfaction is heavily dependent upon the ideal time to market, investments that can affect facility location(s) carry a significant weighting factor. The 12 cents saved in driving CPU from 97 cents down to 85 may prove to be more expensive than face value if customers are put off by the trade-offs.

Implementation Considerations

Finally, for companies looking to implement a new warehousing strategy in 2023, the “go live” gold standard of implementation is “non-event.” No trauma transition plans require significant inputs from a planning team of experts steeped in best practices and multiple disciplines, including, but not limited to: finance, operations, engineering, parcel, IT, and even innovation. Plan execution must then be handed over to a dedicated implementation team that phases in each step over the course of several months. Such time allows for the re-direction of new inbound materials while phasing out activities at locations that will be going offline. Such time also allows for testing, testing, and even more testing.

Should your team need inputs on planning for peak season 2023, check out our Warehousing and Distribution pages on Maersk.com. Now is the time.

Topics, Trends & Insights

Innovating supply chain breakthroughs

In 2021, Maersk created its North American Innovation Center focused on building new products, service solutions, and business models. The work is powered by a team of experts leveraging advanced technologies, data, and analytics strategies. The intended outcome is to go well beyond simple continuous improvement activities and all the way to genuine breakthroughs that change the game for our customer’s success.

To accelerate its efforts, Maersk has established an entire ecosystem of stakeholders in just over a year’s time. The Center partners with customers, investors, start-ups, strategic innovation partners, research facilities, and governments, to rapidly identify challenges and opportunities for research, development, and commercialization. Innovations are exchanged globally, benefiting Maersk customers around the world.

In all, the Center has nine focus areas of effort, among the top being:

- End-to-end supply chain transparency and traceability

- Solutions and models that support supply chain resilience

- Alleviating labor constraints with novel attraction and augmentation solutions

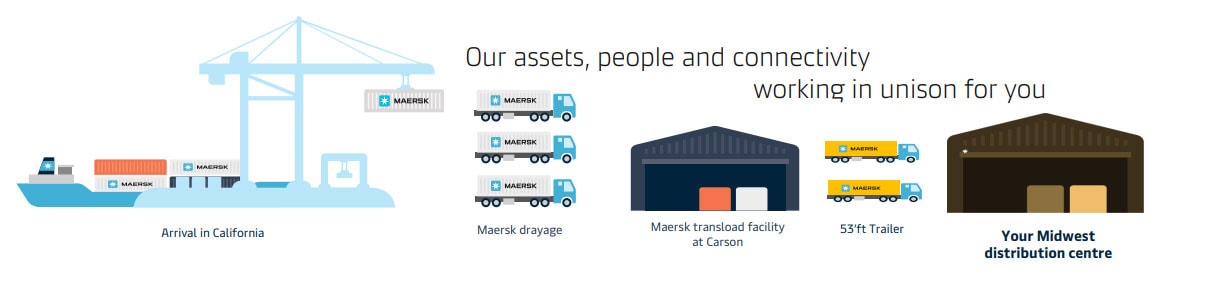

Innovations come in many packages and not always in the form of a piece of amazing technology like AI-infused robotics (which we are actually testing). Innovations can also come in the form of process improvements that solve old problems in new ways for dramatic results. Among such innovations is the “Ocean + Transload” product solution. This innovation involves taking cargo in 40-foot containers from Asia across the ocean into port, then draying the containers to a transload facility to move the goods from three 40’ containers into two 53’ truck trailers, in lieu of transporting the original three containers via intermodal rail. This solution removes a third of the total moves, thereby reducing costs while increasing reliability and speed to market.

In testing and execution, we have been able to document transit time savings with significantly reduced performance variation, allowing customers to greatly improve inventory planning. For example, using intermodal rail from LA to Chicago was taking, on average, 21 days with a variation of +/- 12 days, vs. the “Ocean + Transload” performance of just 8 days with a variation of +/- 3 days. The solution includes a comprehensive visibility component that includes real time location, temperature, humidity, light, and motion/shock data. This data is then aggregated for pattern analysis to reveal potential performance improvements.

Look for more on Maersk innovations soon or email MaerskInnovationWND@maersk.com today.

Maersk announces new executive leadership team and organizational structure

On January 10th, Maersk’s new CEO, Vincent Clerc, announced a new executive leadership team effective February 1st. The new organizational structure is shaped around 15 roles and areas of responsibility. The Executive Leadership Team will jointly own the execution of Maersk’s Integrator strategy and is composed to create strong alignment across the enterprise as well as clear ownership and accountability for key aspects of the next phase of Maersk’s strategy.

Learn more from the global Maersk team

Learn what’s happening in our regions by reading our Maersk Europe, Latin America, and Asia Pacific updates. Visit our newsletters page to subscribe to Maersk updates.

Be sure to visit our “Insights” pages where we explore the latest trends in supply chain digitization, sustainability, growth, resilience, and integrated logistics.

Visit us at Maersk.com to handle everything from "Last Free Day" to online payments.

We value your business and welcome your feedback. Should you have any questions on optimizing your cargo flows, please contact your local Maersk professional.

Get in touch

无论您需要什么,我们都可以随时为您提供帮助

I agree to receive logistics related news and marketing updates by email, phone, messaging services (e.g. WhatsApp) and other digital platforms, including but not limited to social media (e.g., LinkedIn) from A. P. Moller-Maersk and its affiliated companies (see latest company overview). I understand that I can opt out of such Maersk communications at any time by clicking the unsubscribe link. To see how we use your personal data, please read our Privacy Notification.

By completing this form, you confirm that you agree to the use of your personal data by Maersk as described in our Privacy Notification.