A.P. Moller – Maersk would like to inform you of the next steps in the EU Emissions Trading System (ETS) and the impact compliance will have on your supply chain. As of 1 January 2024, shipping will be included into the EU ETS, which sets an annual absolute limit on emissions of certain greenhouse gases (GHG) and requires the purchase of allowances for emissions. Therefore, the inclusion of shipping in the EU ETS puts a price on GHG emissions. The additional cost incurred to comply with the EU ETS directive will be applied to bookings under the EU ETS scope as a standalone surcharge, known as ‘Emissions surcharge’, defined on trade basis. Only bookings where the Load Port and/or Discharge Port of the ocean journey is located in the EU/EEA (European Economic Area) countries in EU ETS scope will be charged with the emissions surcharge.

Example: For a Cargo moving from Country of Receipt as Malaysia to Country of Delivery as Switzerland:

- If the Discharge Port (Ocean) of the Booking is Netherland (EU/EEA Country), we will apply emissions surcharge.

- If the Discharge Port (Ocean) of the Booking is Turkey (Non EU/EEA country), we will not apply emissions surcharge.

For bookings under contracts with validity more than 31 days, surcharge codes will be presented on invoices as “EMS”, while for Spot bookings and Contracts with validity less than or equal to 31 days the surcharge will be presented as “ESS” (Emission Surcharge for Spot and Contracts with validity equal to or less than 1 month). Emission surcharge will be applied on top of the contracted rates. Emission surcharge will be updated every quarter based on latest EUA price. To ensure that invoices are processed correctly and all payments are settled on time, we ask for your collaboration in updating your invoice registration systems to reflect the new surcharge.

For all bookings from China (Hongkong/Taiwan not included), we will add the EU ETS cost (emissions surcharge) to base freight rate instead of an additional surcharge for regulatory reasons. Base freight rate will be adjusted quarterly (increase/decrease) to reflect quarterly updated EU ETS cost (emissions surcharge).

For all bookings into & from Djibouti and Ethiopia, exceptional pay terms will apply due to regulatory reasons. EMS/ESS surcharge for imports into Djibouti and Ethiopia will be on prepaid basis. EMS/ESS surcharge for exports from Djibouti and Ethiopia will be on collect basis.

For more information and frequently asked questions, please visit the FAQ section below.

Should you have any further questions, please contact your local Sales representative. Our teams are always available to support should you need assistance.

Frequently Asked Questions

EU ETS introduces carbon pricing for shipping from 2024. The cost of compliance is expected to keep increasing with the phased implementation. It will be passed on to the customer in the form of a standalone surcharge known as ‘Emissions Surcharge’ to all bookings with Price Calculation Date January 1st 2024 and beyond. It will be applied on top of contracted rates at the booking stage to ensure we charge only bookings where the Load Port and/or Discharge Port of the ocean journey is located in the EU/EEA countries in EU ETS scope.

We seek customer’s support to make sure that all relevant teams (booking, invocing etc.) in their organization are aware of EU ETS Directive and its impact. We also request customers to update their invoice registration systems (and other applicable systems) to reflect the emissions surcharge to ensure that invoices are processed correctly, and all payments are made on time.

Emissions surcharge will be applied to all bookings with Load Port and/or Discharge Port country part of EU/EEA. For all bookings from China (Hongkong/Taiwan not included), we will add the EU ETS cost (emissions surcharge) to the base freight rate instead of an additional surcharge for regulatory reasons. Base freight rate will be adjusted quarterly (increase/decrease) to reflect quarterly updated EU ETS cost (emissions surcharge).

ECO Delivery bookings will not be charged with emissions surcharge. Choosing ECO Delivery means we replace fossil fuels with reduced greenhouse gas (GHG) emissions fuels* within our network and allocate the savings to your shipment. This investment reduces your GHG emissions footprint and aids in decarbonising your supply chain. Learn more about ECO Delivery.

*Maersk defines "reduced GHG emissions fuels" as fuels with at least 65% reductions in GHG emissions on a lifecycle basis compared to fossil of 94 g CO2e/MJ.

It will be shown as Emissions surcharge in the invoice with surcharge code as `EMS´ for all contract bookings (except China export-HK/TW not included) with validity more than 31 days and ‘ESS’ for Spot bookings and contract bookings with validity less than or equal to 31 days.

We cannot charge a fixed amount because the cost of European Union Allowance (EUA) is extremely volatile. To ensure fair pricing, we will update the Emissions surcharge on quarterly basis to ensure alignment to latest EUA price.

Liable Emissions are derived from the EU legislaton.

The below formula shows how GHG emissions from a vessel is derived and reported as part of EU MRV Regulation (for Monitoring, Reporting, Verification).

GHG emissions = Actual bunker consumption * Emission factor

- Currently EU MRV covers only CO2 emissions. However, from 2026 emissions of methane and nitrous oxide will also be covered.

- Emission factor for HFO and VLSFO for CO2 emissions is 3,114 T CO2/MT of fuel.

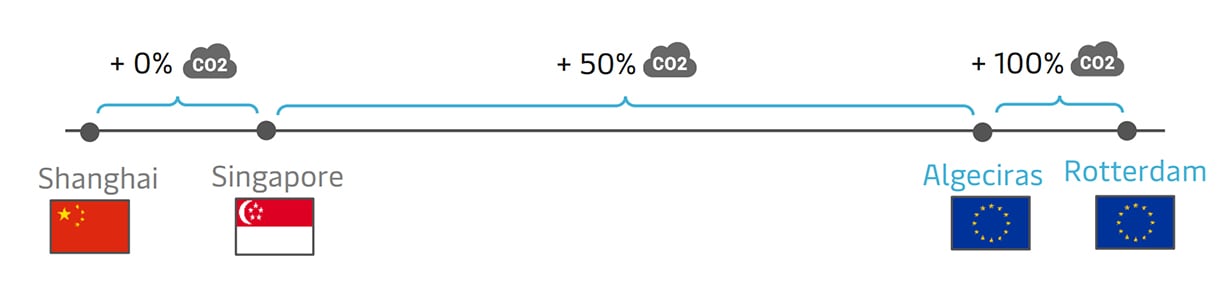

The geographical scope of the EU ETS Regulation is as follows:

- 50% of emissions from voyages which start or end outside of the EU

- 100% of emissions from intra-EU voyages

- 100% of emissions at berth in the EU

Example of Emissions scope for EU ETS on a multi-stop voyage:

As the extension of the ETS to maritime transport activities increases shipping costs, there are concerns about the risk of evasion and transshipment activities moving outside the EU. To mitigate this, the law specifically targets non-EU ports near the EU with a high share of transshipments. For these ports, the ETS effectively extends the length of voyages to address concerns about carbon leakage. Currently, Port Said and Port Tanger Med are the non-EU ports identified and confirmed by the authorities and will be included in the EU ETS surcharge.For example, if a vessel is moving from West Africa to EU via Tanger Med, the shipment will be liable for 50% of emissions performed during the full voyage from port of loading to the destination port in the EU.

The system is introduced with a phase-in period, meaning that 40% of emissions in 2024 and 70% of emissions in 2025 are subject to carbon pricing. From 2026 onwards all emissions (100%) are subject to carbon pricing. In addition to CO2 emissions, emissions of methane and nitrous oxide are included from 2026 onwards.

The EU ETS Directive and the accompanying legislation introduces specific legal requirements for how to calculate, report, and pay for emissions. Carriers must follow these requirements and cannot decide on an alternative methodology for calculating liable emissions in EU ETS.

European Union Allowances (EUAs) are a type of carbon allowance that let companies covered by the EU ETS to emit 1 ton of CO2e. The EU ETS is the world's first major carbon market and remains the biggest one. For every 1 ton of reported CO2e, 1 European Union Allowance (EUA) must be purchased from EU ETS. It applies to all shipping companies, who are responsible for buying EUAs. For sake of transparency, we refer to EUA price from a public Index EUA Futures | ICE (theice.com) to calculate emissions surcharge.

The price of EUAs is expected to be change with time. To support customers in planning their supply chain effectively through fair and stable pricing, we will perform quarterly reviews and updates of emissions surcharge based on last 3 months average price for European union allowance (Daily futures) using the public index i.e., ICE website: EUA Futures | ICE (theice.com). Please find below the date ranges to be referred for average EUA price (Daily Futures) to be used for EU ETS surcharge calculations.

| EU ETS surcharge for | Reference Period for Average EUA price (Daily Futures) |

|---|---|

|

EU ETS surcharge for

Q1: Jan 1 to March 31

|

Reference Period for Average EUA price (Daily Futures)

Aug 16 to Nov 15

|

|

EU ETS surcharge for

Q2: April 1 to June 30

|

Reference Period for Average EUA price (Daily Futures)

Nov 16 to Feb 15

|

|

EU ETS surcharge for

Q3: July 1 to Sep 30

|

Reference Period for Average EUA price (Daily Futures)

Feb 16 to May 15

|

|

EU ETS surcharge for

Q4: Oct 1 to Dec 31

|

Reference Period for Average EUA price (Daily Futures)

May 16 to Aug 15

|

Please find below the emissions surcharge for Q1 2024 calculated based on average EUA price of EUR 81.54 for period of 16 August to 15 November 2023, Emissions surcharge (EMS/ESS).

ECO Delivery bookings will not be charged with emissions surcharge. Choosing ECO Delivery means we replace fossil fuels with reduced greenhouse gas (GHG) emissions fuels* within our network and allocate the savings to your shipment. This investment reduces your GHG emissions footprint and aids in decarbonising your supply chain. Learn more about ECO Delivery.

*Maersk defines "reduced GHG emissions fuels" as fuels with at least 65% reductions in GHG emissions on a lifecycle basis compared to fossil of 94 g CO2e/MJ.

There are several resources with more information about EU ETS: watch the introduction video, read more in our ETS article, or visit the official EU ETS pages of the European Commission.

Should you have any further questions, please contact your local Sales representative. Our teams are always available to support should you need assistance.

相关文章

查看所有新闻提交此表,即表示我同意通过电子邮件接收 A. P. 穆勒-马士基集团及其关联公司接收物流相关新闻和营销信息更新。我了解我可以随时通过点击退订链接,取消接收此类马士基推送信息。如需查看我们会如何处理您的个人信息,请查阅隐私公告。