The world of regulatory affairs within logistics can be challenging to understand and navigate. Still, it is shaped by essential agreements to stir the industry and advance progress. In the last months, a multitude of great and relevant points have been touched upon by the EU and the IMO, but today we focus on a selected few to clarify what do these mean for our customers.

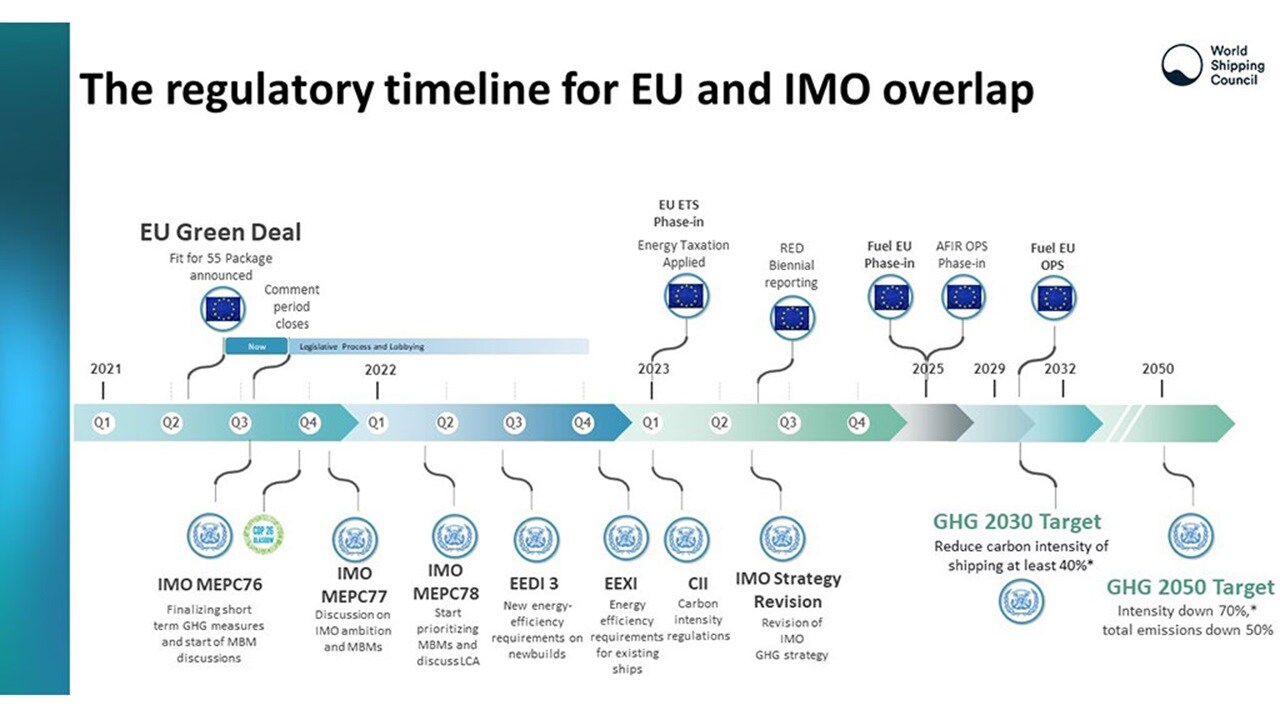

To reduce emissions of greenhouse gases (GHG) from international shipping, the International Maritime Organization (IMO) and the European Union (EU) are in the process of discussing, or have already adopted, mandatory measures for their Member States to respect. Other jurisdictions are also looking into similar or alternative schemes but are less advanced.

EU Emissions Trading System (ETS)

On July 14, 2021, the European Commission published its “Fit for 55” package, which includes several important proposals for shipping. Among these, the inclusion of shipping into the EU Emissions Trading System (ETS) which sets an annual absolute limit on emissions of certain greenhouse gases (GHG) and requires the purchase of allowances for emissions, thereby putting a price on emissions. Maersk supports the inclusion of shipping into the EU ETS provided that the system encourages the right behaviour and investments, such as vessels that sail on carbon neutral fuels including green methanol.

What does this mean for our customers? The cost of compliance with the ETS will likely be significant therefore impacting the cost of shipping. It is expected that the volatility of the European Union Allowance (EUA) traded in ETS may increase, as the revised legislation comes into effect. To ensure transparency, we intend to apply these costs as a standalone surcharge. Based on what we know as of today, below are estimates of cost increases for selected trades in 2023.

Following the latest developments, we have assumed the price of the European Union Allowance to be around EUR 75 for this exercise. Kindly note that in 2023 our obligation is to purchase allowances equal to 20% carbon emitted, which would increase to 45% in 2024, 70% in 2025 and 100% in 2026 in line with the current legislative proposal.

Examples of estimated cost increases for sample trades (based on current assumptions for a number of input factors subject to change)

| Trade | DRY (in EUR) | REEFER (in EUR) |

|---|---|---|

|

Trade

North Europe to Far East

|

DRY (in EUR)

16

|

REEFER (in EUR)

25

|

|

Trade

Far East to North Europe

|

DRY (in EUR)

28

|

REEFER (in EUR)

42

|

|

Trade

CAM to Europe

|

DRY (in EUR)

29

|

REEFER (in EUR)

44

|

|

Trade

WCSA to Europe

|

DRY (in EUR)

35

|

REEFER (in EUR)

53

|

FuelEU Maritime

A proposal was also presented for a FuelEU Maritime regulation, intended to push the demand for uptake of alternative fuels and zero emissions at berth. Maersk generally supports all measures that can promote the supply and demand for alternative fuels.

What does this mean for our customers? Alternative fuels are today more expensive than fossil fuels. As the percentage of sustainable fuels increases in line with the regulation, the ability to source and supply the fuels in the required quantity will impact price levels.

IMO – Short term measure

To meet its ambition of reducing the carbon intensity of international shipping by 40% by 2030, the IMO agreed in June 2021 on a set of short-term measures consisting of three main elements:

- EEXI: A technical measure for existing ships.

- A Carbon Intensity Indicator (CII) to determine the operational energy efficiency performance.

- A rating system where vessels will be rated as A, B, C, D and E vessels.

Maersk is in full support of reaching more progress in the area of decarbonisation and hopefully CII and EEXI can be one step in the right direction. On EEXI we foresee limited actual impact other than selected vessels will have their actual speed catch-up ability limited. However, there are a number of elements in the CII that we believe will not provide optimal incentives for higher efficiency of vessels. For instance, the calculation is based on the deadweight of a vessel rather than the actual cargo the vessel carries. Thus, the CII does not incentivize cargo optimization. Moreover, there is no actual enforcement of the measure, and it is therefore, in the end, up to the shipowner to assess what extend all vessels should comply. Finally, there is no real incentives for fully carbon neutral vessels. The highest rating possible is an A rating which still contains emissions. In a world where every year counts in the battle against climate change, Maersk believes that the IMO should push shipowners to invest in carbon neutral vessels ASAP.

Figure 1: Examples of causes for the different ratings

| Rating | Explanation | Example |

|---|---|---|

|

Rating

A

|

Explanation

Only the highest performing vessels

|

Example

Usually vessels that are not only efficient but have a certain size and trade long distances

|

|

Rating

B

|

Explanation

Vessel is performing above average

|

Example

Generally, vessels which are operated very efficiently . These could be partially fueled with low carbon fuel

|

|

Rating

C

|

Explanation

Vessel is in compliance

|

Example

Generally, vessels which are efficiently operated. These could be partially fueled with low carbon fuel

|

|

Rating

D

|

Explanation

Vessel is performing below average, D-rating allowed for max 3 consecutive years

|

Example

There are various possible reasons for rating below average. It may be related to the vessels’ efficiency but it may also be related to other factors, for instance waiting time outside port, carrying certain cargo*. This may consequently vary substantially from year to year

|

|

Rating

E

|

Explanation

Vessel is performing below average and corrective action plan must be developed immediately

|

Example

Often vessels which trade shorter distance and have higher port time, which can impair the CII significantly

|

*It is still being debated at the IMO whether consumption of cargo, for instance of reefers, should be included in the CII and thereby in some cases cause a poor rating although the vessel in itself is highly efficient.

Other IMO discussions on decarbonization agenda

Maersk is calling for much more action at the IMO the coming year. At present, progress is not happening fast enough. For Maersk, the solution for coming measures must be ambitious to secure the green transition for global shipping. At the same time, all IMO measures should be future-proofed, meaning based on full Life Cycle Assessment and include all relevant GHGs. As such, Maersk finds that the right solution is a package of measures centered around:

- A global fuel standard (securing the needed production of the new fuels)

- A ‘drop-dead clause’ to stop the production of fossil fueled ships

- A global fund and GHG price to secure just transition (i.e. channeling support to developing countries)

- Initial deployment of green corridors

- Enhance the IMO data collection system and transparency of that data

Finally, the IMO should adopt a target of at least net-zero emissions in 2050 when the IMO GHG strategy is finalized in 2023.

What does this mean for our customers? Given the results of the discussions, we are still in process of analyzing the details of the regulations and the implication it might have on our customers. Rest assured that we will make sure to inform you on this as soon as it is possible.

We hope this gives you a better understanding on the recent regulations put in place by both the IMO and the European Union. If you’d like to learn more or have questions, you can always get in touch with your Maersk Sales Representative or our Regulatory Affairs team at simon.bergulf@maersk.com.

Read our CEO Søren Skou’s stand on the recent IMO meeting: here

For more detailed information on the IMO GHG, kindly visit: here

For more detailed information on the EU “Fit for 55” package, kindly visit: here