For the latest regional updates, please click here and select your region

In the Summer 2025 edition of the Maersk Global Market Update, we explore how businesses are responding to the uncertainty from shifting tariff landscapes and evolving global demand patterns. From the latest developments in tariff policies to China's expanding role in global exports, this edition offers a comprehensive look at the factors shaping container flows, sourcing decisions, and customs planning.

With volatility showing no signs of slowing, staying informed and adaptable remains key to maintaining resilience and driving growth.

Taking stock of tariffs

Since our Spring 2025 update back in April, we’ve seen the US introduce, suspend, and sustain tariffs on imports from many countries around the world. Visibility has worsened and trade barriers have increased since the US formally announced its tariff package to the world on 2nd April.

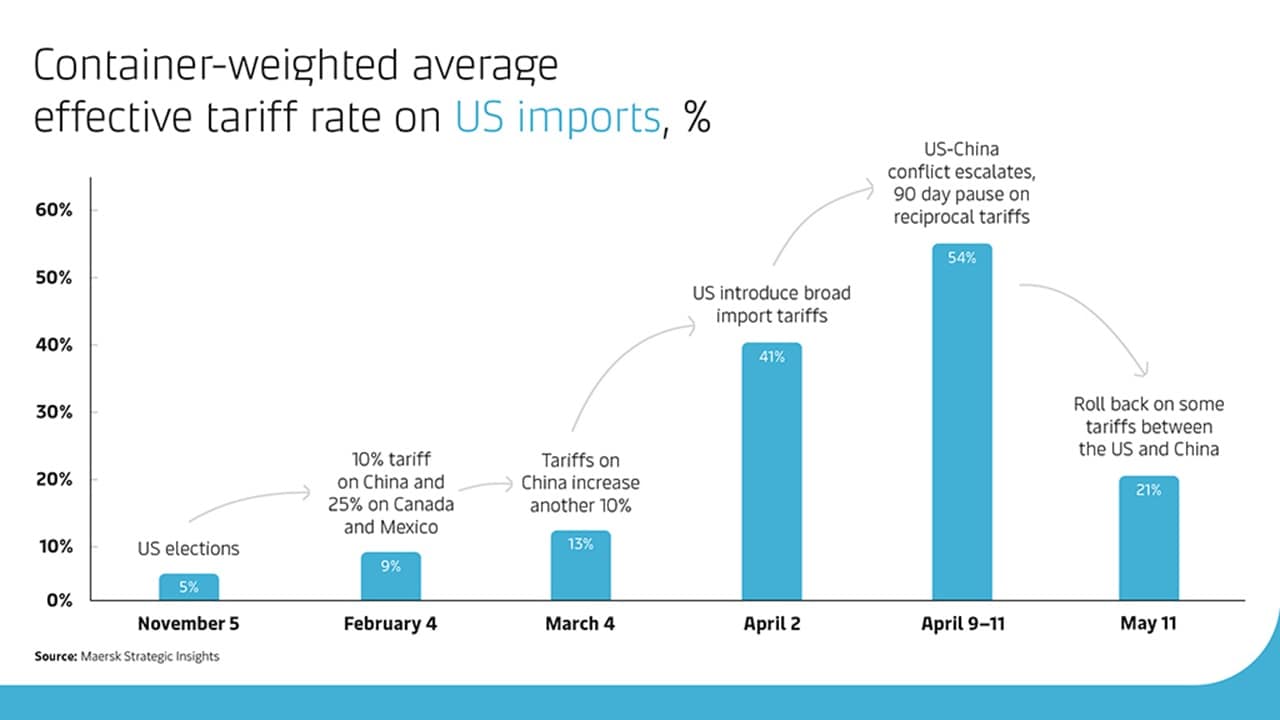

For now, most country-specific import tariffs are paused while long-term deals are being negotiated, with deadlines coming up in July and August. However, there are still trade tariffs impacting how companies move their cargo, particularly between the US and China. On average, companies are currently paying an effective average tariff rate of approximately 21% relative to container load on all US imports, according to Maersk’s container-weighted effective average tariff rate metric . At its peak, shortly after 2nd April, the average effective rate was 54%.

In certain supply chains, such as the automotive sector, goods and parts can cross borders five to six times during the manufacturing process. This means that the right customs plan can be a gamechanger for both efficiency and price, while failing to properly prepare for customs is adding unnecessary stumbling blocks. About 20% of all delays at borders are caused by insufficient customs preparation, according to the World Trade Organisation and supported by Maersk’s internal data. And Maersk data also shows us that most companies end up overpaying tariffs by about 5-6%, because they lack a centralised approach and overview of their customs duties.

There are essentially two things to focus on when navigating the current trade environment: you need the right supply chain design, and you need agility when it comes to your shipments. With increased uncertainty on tariffs, it is crucial for our customers that they can move goods flexibly when a window of opportunity opens for them or demand signals warrant it. Agility is a competitive advantage in times like these.

“Finished products today are complicated in that they are often being manufactured in several countries and cross borders several times. Optimising border crossings is something businesses need to take a very strategic approach to when dealing with higher trade tariffs. It all starts with good supply chain planning,” adds Karsten Kildahl.

Although the global tariff situation remains volatile and difficult to predict, getting ahead of the curve is crucial for success. Contact Maersk's Global Trade and Customs Consultants and visit our new Trade and Tariff Studio, which uses AI-powered tools to detect upstream risks before they appear and provides real-time updates.

China continues to expand its role in the global economy

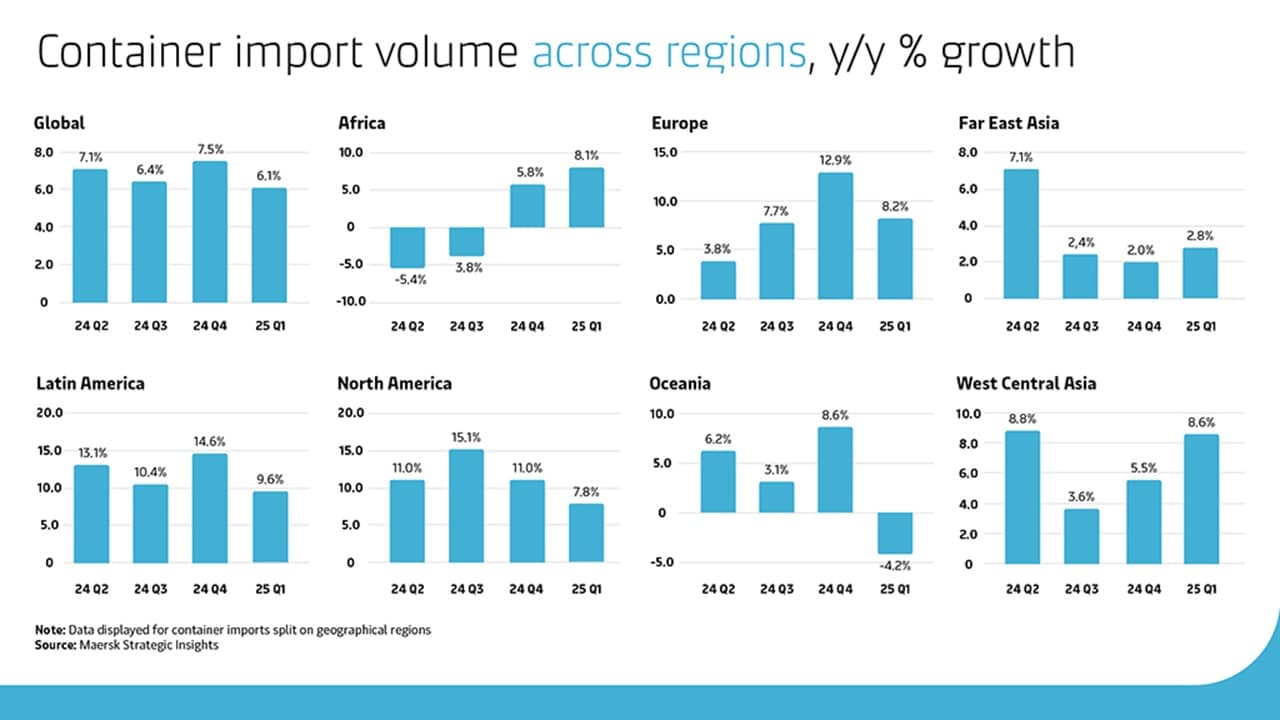

Looking back at the beginning of the year, global container demand grew 6.1% in Q1 2025, which is on par with previous quarters. Q2 figures are not yet final but will reveal a high degree of volatility triggered by tariff announcements. In the Q1 Interim Report in May, Maersk forecasted 2025 global container demand to be within a wide range of –1% to 4%, with the conservative view reflecting higher tariffs and potential lower consumer spending in the second half of the year.

We have seen robust container demand growth in the first half of 2025. What played out was not completely unexpected, and we did see customers advance orders ahead of the tariff announcements. This was more common among manufacturers and less among retailers, but overall we believe that the volume shipped reflects demand. We do not notice significant inventory level increases.

The ongoing trade dispute with the US and China at its centre has once again sparked political debate about whether it’s relevant for businesses in the Western hemisphere to reduce dependency on foreign manufacturing – in particular China during a time of geopolitical uncertainty. Potential strategies like nearshoring or friendshoring to reduce the dependency on China by moving sourcing to other areas are often talked about, but in reality, these geopolitical ambitions have not yet materialised significantly. Looking at trade flows, Europe has steadily increased its imports from Far East Asia over the past five years in containerised ocean volumes and when looking at Far East Asia’s share of European imports. This has happened at a time where European politicians have voiced an ambition to derisk from China and its manufacturing muscle amid competitive concerns and geopolitical spats.

Conditions to manufacture goods remain extremely beneficial. Producer price deflation and exchange rate dynamics are among contributing factors in China’s export boom. Total market imports from Far East Asia constituted 51% of total European imports in 2024, compared to 49% in 2019. Intra-Europe imports and European imports from North America were both down in the same period. China’s total export in 2024 was about 25% higher than in 2019 before the Covid pandemic – an annual compounded growth rate of about 4.5%.

Some US customers have reduced dependency of China

It wasn’t a big surprise that the trade conflict between China and US would continue under the new US administration, and Maersk’s volumes from China to US shows that American importers have worked on consistently decoupling from China over the past years.

In recent years we have seen a deliberate strategy from many of our large US customers to reduce import dependency from China. Many apparel and fashion customers have now reached single-digit China dependency, whilst other commodities like home improvements have a significantly higher level of Chinese manufacturing due to the nature of the goods. This is not just a short-term tactical reaction to escalating geopolitical tensions, but rather a long-term strategic move to future-proof supply chains and remain resilient.

Looking beyond the tariff impact on trade and supply chains, consumer sentiment in the US has deteriorated in recent months, aligning with a 1.8% drop in US durable goods demand in May. At its June meeting, the U.S Federal Reserve cut its 2025 forecast for US gross domestic product growth from 1.7% to 1.4%, but kept its policy interest rate steady at 4.25-4.5%.

Looking ahead, the whole world is on tariff watch in July and August where various deadlines for potential trade deals with the US expire. The outcome of these negotiations will of course colour global trade and consumer sentiment in the months to come. This is something we will look into in the Autumn edition of the Maersk Global Market Update, which will be published in October. It is difficult to predict what will come next but as the environment continues to evolve, staying proactive and informed will be essential to maintaining a competitive advantage. Please don’t hesitate to contact us and discuss how we can support your supply chain.

In other news…

Middle East situation: With the prospect of a ceasefire agreement bringing de-escalation to the conflict in the Middle East, Maersk has decided to resume vessel calls to the Port of Haifa, and acceptance for both import and export cargo is now open. We will continue to monitor the situation closely and will be ready to make changes if safety concerns reappear. For the latest updates, click here.

Red Sea latest: While Maersk continues to hope for a sustainable resolution in the near-future that will guarantee safe passage through the Red Sea, the situation in the area is constantly evolving and remains highly volatile. Recent events show that the security risk continues to be at a significantly elevated level and therefore has the potential to impact your logistics operations. We will continue to keep customers informed here.

Ocean reliability: Sea-Intelligence published their monthly schedule reliability figures for May, which includes data showing sailings under Maersk and Hapag-Lloyd's Gemini Cooperation. Data showed that Gemini vessels delivered schedule reliability of 90.9% in May, above the 90% ambition. The network was fully implemented in June.

Get the latest information from your region

1 The container-weighted average effective tariff rate is calculated using the country-specific and good-specific tariff rate imposed on US imports, weighted relative to the composition of containerised imports arriving at US ports in 2024.

2 Maersk defines Far East Asia as Brunei, Cambodia, Chinese mainland, Hong Kong SAR, Indonesia, Japan, Korea, Macau SAR, Malaysia, Mongolia, Myanmar, Philippines, Russia, Singapore, Taiwan region, Thailand and Vietnam. Chinese mainland made up 61% of exports from the region in 2024. While Russia is included in the total market volumes, Maersk stopped doing business in Russia in 2022.

无论您需要什么,我们都可以随时为您提供帮助

I agree to receive logistics related news and marketing updates by email, phone, messaging services (e.g. WhatsApp) and other digital platforms, including but not limited to social media (e.g., LinkedIn) from A. P. Moller-Maersk and its affiliated companies (see latest company overview). I understand that I can opt out of such Maersk communications at any time by clicking the unsubscribe link. To see how we use your personal data, please read our Privacy Notification.

By completing this form, you confirm that you agree to the use of your personal data by Maersk as described in our Privacy Notification.