Over the past two decades, semiconductors have taken on increasing importance in global markets. Not only do semiconductors underpin the functioning of devices like smartphones, laptops, tablets, and various communication tools, but they have also become integral components in the automotive industry, data centres, and in numerous other applications.

However, Europe’s semiconductor industry has encountered various complications in recent years, with the likes of the COVID-19 pandemic and geopolitical instability bringing about unforeseen challenges and turbulence. And with the technology market already grappling with multiple critical factors – including inflation, reduced consumer spending, increased labour strikes in Europe, escalating energy prices, and more – the impact has been particularly poignant.

Add this to Europe’s heavy reliance on Asia for semiconductors making it all the more vulnerable during recent periods of supply chain instability, and it’s clear resilient changes are needed. But in the midst of these challenges, a relatively new player entered the scene capable of fortifying Europe's semiconductor sector: Turkey.

Turkey’s expanding role in the semiconductor industry

As the traditional trade routes from Asia have faced mounting pressure in recent years, European companies are actively focusing on strengthening intra-European connections through near-shoring and near-sourcing.

Semiconductors and their availability remain critical for several core European industries, but near-sourcing opportunities have typically been sparse given that Europe consumes twice as many chips as it produces. However, the European Union is taking action and is set to invest over €43 billion in bolstering its own semiconductor production by 2030.

Turkey has emerged as one of the most significant tech and semiconductor producers and distributors among non-EU states within the European zone. Its strategic location between Europe and Asia, coupled with substantial investments by the Turkish government in research and development, has fostered a favourable environment for the growth of semiconductor companies. In fact, according to Statista, Turkey's semiconductor revenue will increase from 730 million USD in 2023 to 931 million USD by 2027.

The automotive industry, for example, is a critical sector for Europe and is particularly benefiting from Turkey's semiconductor capabilities. The trend towards electric and autonomous vehicles has made for an increased demand for advanced semiconductors across Europe, however this demand is now being met by Turkish manufacturers producing chips for vehicle control systems, infotainment, and sensors. This is even more significant when you consider that the European automotive sector has been striving to compete in the electric vehicle segment on a global scale – and Turkey’s semiconductor production means it now has the platform to do it.

Turkey is seizing the opportunity to expand its partnerships with other regions, too. In July 2023, the country announced joint investments with Qatar for semiconductor production. Simultaneously, Turkey is accelerating investments in the new generation of hybrid and electric vehicles, with the aim of increasing its export capacity and meeting domestic demand.

Supply chain impact in Europe

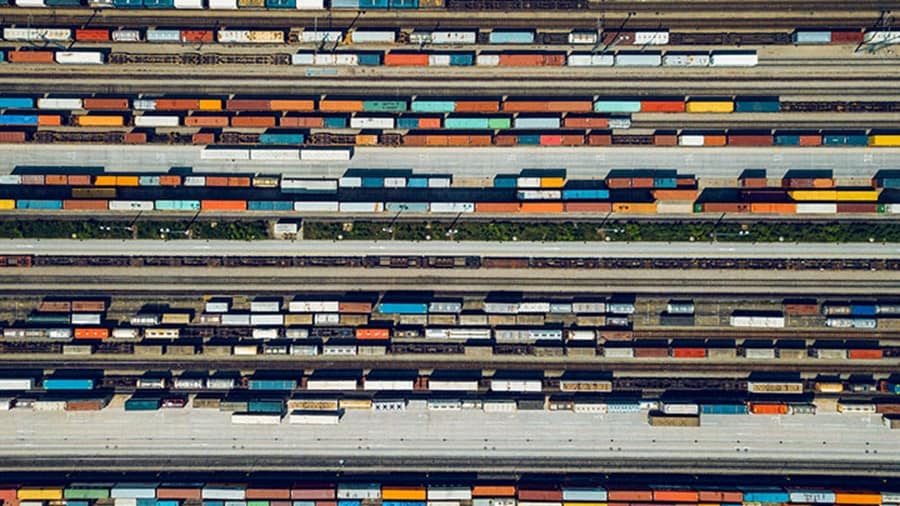

The tech market's growing emphasis on intra-European connections is inevitably reshaping supply chains. While connections to and from Asia and North America continue to dominate, regionalisation means the industry has become more flexible and increasingly capable of offering European alternatives.

Research on technology supply chains suggests that many European tech companies are factoring in two crucial aspects when re-evaluating their supply chains. Firstly, they are decentralising away from low-cost production centres to reduce the risk of disruptions or shutdowns from unforeseen events. Secondly, there is a heightened focus on shifting production closer to end markets for higher-margin products. This means that countries in close proximity to consumer centres, like Turkey, have assumed greater importance for European markets.

Therefore, Turkey's growing role in the European semiconductor industry represents a significant step toward strengthening supply chains and promoting technological self-sufficiency. Nevertheless, it is imperative to analyse this development critically and consider the associated risks.

On one hand, Turkey presents Europe with the opportunity to diversify semiconductor sources and reduce reliance on external suppliers. It also contributes to the growth of the Turkish technology sector, thereby fostering economic development. On the other hand, Europe must ensure the reliability, quality, and security of semiconductor supply chains from Turkey and continuously adapt its strategies to the evolving dynamics of the industry and global landscape.

The strategic placement of semiconductor production facilities will prove pivotal for the enduring viability of major manufacturing facilities. For example, certain factories in Eastern Europe contend with outdated infrastructure, while peripheral countries close to Europe may lack extensive experience in exporting electronics. The deficiency in infrastructure is particularly noticeable in the less robust supply chain support from first-tier suppliers in North America and Europe when compared to their East Asian counterparts. Consequently, plans are in motion to bolster this infrastructure in the coming years to establish truly resilient supply chains. The location of such production facilities holds particular significance, and the role of the respective state and the extent of its support should not be underestimated.

Government incentives are indeed nice to have because they can influence investment decisions. But the greatest value that the government brings is creating the right framework for the success of long-term projects through political and economic stability. Thus, policy continuity and trade condition stability are the crucial components to develop a mature ecosystem with qualified workforces. This focus trumps a short-term government incentive.

The growing role of Turkey in the semiconductor industry is exerting a profound impact on supply chains within Europe. Adapting to existing suppliers in Turkey means adjustments in logistics, quality control, and risk assessments, along with the expansion and enduring optimisation of infrastructure.

However, as Turkey continues its upward trajectory in the market and becomes a hotspot for semiconductors in Europe, the reliance on Asia can begin to be relinquished and add both security and flexibility to supply chains.

未来,您想随时了解必读行业趋势吗?

您已经完成了,欢迎“登船”!

很抱歉,发送您的联系请求时出现问题。

请查看表单字段,确保所有已正确填写所有必填信息。如果问题仍然存在,请联系我们的支持团队以获得进一步的帮助。

未来,您想随时了解必读行业趋势吗?

使用此表格注册,即可直接在您的邮箱中接收我们的洞察见解,进入一个真正的综合物流世界。简单操作,即从我们为您量身定做的精选文章中获得启发,了解相关行业洞察信息。您可以随时取消订阅。