Pakistan’s economy was on an upward trend in FY 2022 (ending June 2022), registering a GDP growth up to 6% as compared to 5.7% in FY2021. However, according to the Asian Development Outlook (ADO) April 2023, political tensions, global turmoil and economic vulnerabilities intensified in the second half of the year 2022 which is expected to significantly impact the growth prospects of the country in FY2023.

The retail industry in Pakistan witnessed drops in sales as consumers faced inflationary pressures and aftershocks from the flood. Pakistan is predominantly an importer of oil and an exporter of agricultural commodities. Inflationary pressures stemming from the global hike in oil prices has created a domino effect as consumers were forced to tighten their belts and lessen spending. The nationwide devastation by floods in 2022 further compounded the issue while also depleting the country’s stock of food and livestock for even domestic consumption.

The challenging external environment, the ongoing foreign exchange crisis and tighter macroeconomic policies also led to a drastic increase in the price of commodities as well; the sectors in which the consumers felt the biggest impact of this include the prices for Transport as well as Food & Beverages. The month of Ramadan also saw a spike in prices of clothing which further impacted the country’s consumer price index.

Trends that Kept Pakistan’s Retail Industry Afloat

Despite the ongoing challenges, the retail industry in Pakistan has managed to stay afloat as a result of 4 key trends.

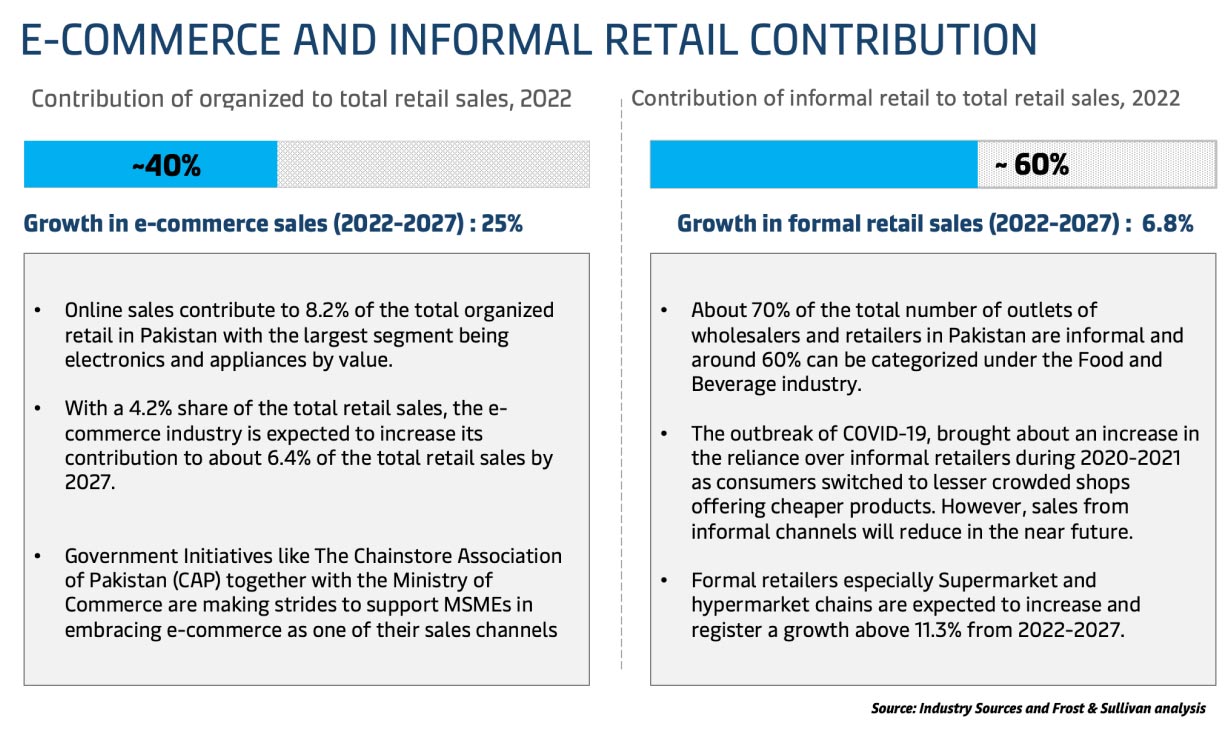

Trend 1: Informal retailers & e-commerce keeping the momentum going in Pakistan

Small grocers and other informal shops have been key contributors to continued sales for the retail industry in Pakistan as they offer lower prices when compared to formal chain stores. With inflation and impact of COVID-19, the masses prefer purchasing from these informal outlets to lower their total expenditures. The pandemic also fast-tracked the culture of online shopping due to the safety precautions that consumers had to follow. As a result of the convenience that consumers experienced from purchasing a product and having it delivered to their doorstep, e-commerce continued to thrive even after the lifting of restrictions. In the recent period, despite feeling purse-pinched, consumers still pursue online retail for purchases in order to browse through a wide range of products with prices ranging from cheap to expensive.

Trend 2: Retailers are eyeing expansion to medium sized cities

The country’s retail landscape is slowly changing, as Pakistan’s medium sized cities are under the focus of modern and grocery retailers. With government initiatives from the Federal Government Employees Housing Authority (“FGEHA”), housing projects in eight cities - Rawalpindi, Islamabad, Lahore, Peshawar, Quetta, Multan, Faisalabad and Karachi – will be developed. The future will see the population of medium sized cities increase and therefore large retail establishments are expanding to such cities to expand their consumer base. This also marks an opportunity for retailers in urban areas as growth continues. The population continues to shift with 42% of the population located in urban areas in 2022, which is expected to grow to 43% in 2023. This will create potential for retailers in these areas creating more demand and opportunities as consumers increase.

Trend 3: Digital Payment Platforms empowering consumers

The availability of e-commerce platforms, coupled with the variation of product categories and cheaper alternatives serves as a major factor for Pakistani consumers to opt for online transactions over traditional brick-and-mortar channels. Retailers are adopting various payment methods which eases the burden of payments on consumers. These include paper, electronic, point of sale (POS), online and mobile payments amongst other. Apart from these, the State Bank of Pakistan (SBP) launched ‘Raast’ in 2021, the first digital payment system enabling online payments. Furthermore, the Quick Response code was also initiated and standardized in 2022 to process quick payments which further unburdens the consumers.

Trend 4: Flexible Payments enabling consumer spending

Retailers in Pakistan have been making steps to mitigate the risks and challenges brought about by the inflationary pressures. They have implemented payment flexibility through partnership with banks to provide a new payment solution for strengthening consumer’s purchasing power by delaying payments. In 2022, Carrefour partnered with Bank Alfalah to offer the “Buy Now, Pay Later” initiative that encourages buyers to make purchases even with limited budget. The growth of the retail industry, however, would require necessary steps to combat the on-going challenges such as secure online payments, scarce connectivity in rural areas, inefficient logistics system, and lack of training for the workforce and businesses.

The Future of Retail and E-Commerce in Pakistan

Pakistan is currently in a state of recovery with support from several countries and entities like the International Monetary Fund (IMF). Furthermore, increased spending by the government is expected to counterbalance the damage, supply shocks and disruption to economic activity during the first half of the fiscal year, i.e., July – December 2022. Sustained macroeconomic policies, reform implementation, improving external conditions and recovery from supply shocks caused by flooding, can improve the GDP growth of the country up to 2% by FY2024.

The country has been making strides in boosting retail sales capabilities, especially in current times, by leveraging e-commerce and the untapped retail market demand through expansion in new locations. The Digital Strategy of the country coupled with the immersion of Pakistani consumers into e-commerce platforms are creating an opportunity for an additional stream of retail sales. So what does the future of the retail and e-commerce in Pakistan look like?

- E-commerce giants spreading their presence in Pakistan

- Organized retailing to expand significantly

- Warehousing and economic zones to promote growth

There is a huge growth potential for e-commerce as it is still at its nascent stages. Pakistan has been receiving investments, from UAE and Saudi Arabia to name a few, for e-commerce and ancillary services such as last-mile, infrastructures, payment systems and e-commerce partnerships. With the lifting of its ban in 2021, Amazon established its presence in Pakistan in May 2021 and is expected to increase e-commerce sales by a great margin with its range of products and popularity in the global market. Furthermore, Alibaba has set-up its facility in Sialkot in 2022, placing the country in the international e-commerce radar. This will help the country to be recognized as sellers gain visibility in the e-commerce platform. This would mean Pakistan would not only cater for domestic but also for international markets that will help increase the country’s export trade.

The organized retailing segment is expected to rise with large grocery and hypermarkets. Although informal stores will continue to dominate the market, organized stores will expand their reach and sales. The rising momentum of Pakistan in the retail and trade scene will attract more international investors and companies to set-up their presence in Pakistan. The country might be at its early stages but attempts to launch digital payments and banking is already under way and is projected to help in creating a seamless model for the e-commerce ecosystem. This opportunity will help MSMEs to be confident in diving into the retail and e-commerce industry, taking advantage of the vast market and rising demand for it.

With the China-Pakistan Economic Corridor (CPEC), more investments are expected to be brought in to support the ongoing construction of special economic zones which includes Rashakai, Dhabeji, Bostan and Moqpondass Special Economic Zone in addition to the Gwadar Port and free zone. CPEC is also supporting the construction of Industrial cities which will house more warehouse facilities to support the trade that will be brought about by the project. With the need for modern warehousing facilities and fulfilment centres as e-commerce expands, the country will see a rising trend of modern storage facilities that house technologies and digital implementation that are necessary for e-commerce operations.

未来,您想随时了解必读行业趋势吗?

您已经完成了,欢迎“登船”!

很抱歉,发送您的联系请求时出现问题。

请查看表单字段,确保所有已正确填写所有必填信息。如果问题仍然存在,请联系我们的支持团队以获得进一步的帮助。

未来,您想随时了解必读行业趋势吗?

使用此表格注册,即可直接在您的邮箱中接收我们的洞察见解,进入一个真正的综合物流世界。简单操作,即从我们为您量身定做的精选文章中获得启发,了解相关行业洞察信息。您可以随时取消订阅。